Alaska moves toward statewide sales tax

TaxConnex

MAY 2, 2023

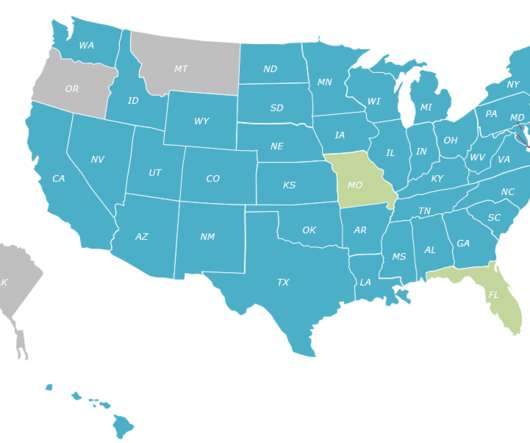

Alaska Gov. Mike Dunleavy is reportedly preparing to introduce a sales tax as part of a long-term budget plan for the state. Five states don’t have a statewide sales tax: New Hampshire, Oregon, Montana, Alaska and Delaware (aka the “NOMAD” states). Vermont was the last state to adopt a sales tax, in 1969.

Let's personalize your content