When do I have to start collecting out of state sales tax? Part 1

TaxConnex

JULY 19, 2022

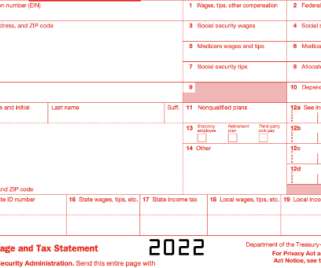

You can create it in a state by having a store or office space there – or often simply by having sales or service reps do business in the state.). What’s taxable? regarding sales tax and business growth, as was understanding taxability of products and services. Taxability, like nexus, can differ across state lines.?If

Let's personalize your content