5 Benefits of Sales and Use Tax Overpayment Reviews | TaxConnex

TaxConnex

NOVEMBER 30, 2023

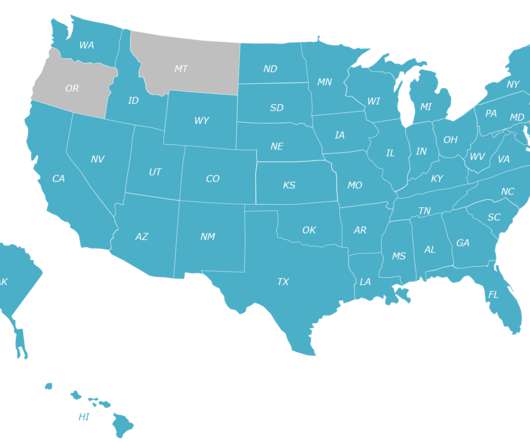

Blog authored by Scott Schwertner, National Director of Sales and Use Tax for Invoke Tax Partners. It is common for businesses across the United States to pay sales tax and accrue use tax on purchases that are not taxable, resulting in an unnecessary hit to their bottom lines each year.

Let's personalize your content