How to Use Microsoft Copilot for CPA Firm Marketing

CPA Practice

MAY 9, 2024

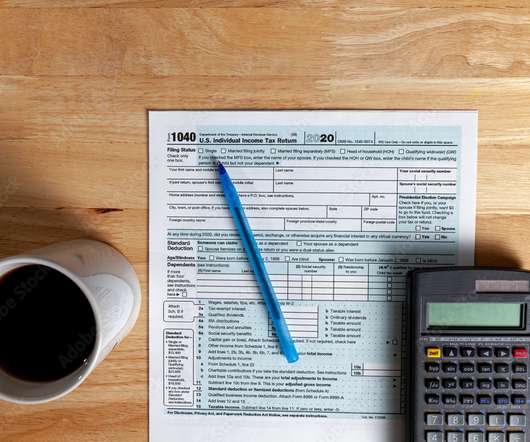

What is Copilot? What challenges does Copilot solve for accounting firm marketers? Whether it’s creating social media posts, writing blog articles, or drafting ad copy, define the purpose and desired outcome upfront. Provide Detailed Instructions: Give Copilot specific instructions on the type of content you need.

Let's personalize your content