How to Master MTD in 60 Minutes: The Practical Blueprint for Busy Accounting Firms

Accounting Web

JULY 24, 2025

HMRC & policy Tags HMRC Income tax Making tax digital

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Web

JULY 24, 2025

HMRC & policy Tags HMRC Income tax Making tax digital

Nancy McClelland, LLC

JANUARY 12, 2025

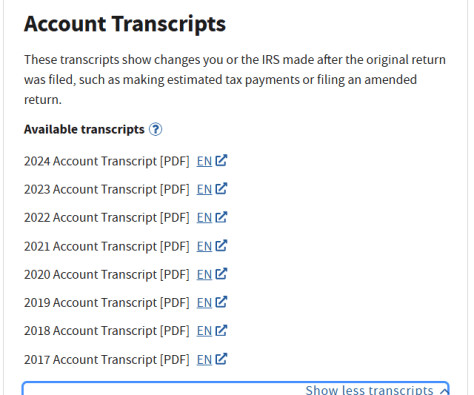

Our firm is located in Chicago, so to get a list of the estimated tax payments youve made to the state of Illinois, go to [link] (without logging in) and enter your SSN, Name, and the tax year in question. You make sure to use your accountant’s secure file transfer system to send them your PDFs. ” Seriously?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Accounting Today

JUNE 6, 2025

The upgraded income tax return solution now includes enhanced client onboarding workflows that allow firms to create multiple engagements in bulk to accelerate onboarding. with a Stripe account to accept in-person contactless payments with their iPhone and the Xero Accounting app.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CPA Practice

JULY 9, 2025

Platform is continually building out an ecosystem to provide collaborative, best-in-class professional services from tax to wealth management, ERP consulting, business accounting services and more. Thanks for reading CPA Practice Advisor!

CPA Practice

JUNE 25, 2025

Unlike some providers, we don’t charge extra to access a business account. Get dedicated business support. Remitly’s business account comes with fast, knowledgeable help from specialists who understand your business. Send without surprise costs.

SkagitCountyTaxServices

MAY 1, 2025

Specifically related to hiring dependents, it shifts income from your higher personal marginal tax bracket to their lower one, because the wages you pay your child are income tax-free for the child if theyre under the standard deduction. Treat them like any other employee.

SkagitCountyTaxServices

NOVEMBER 8, 2023

For you as a business owner, besides jumping on opportunities, you’ll also want to stay abreast of things that might affect your business with Uncle Sam. The IRS will be focused less on working-class taxpayers and increasingly toward high-income individuals and corporations.

LyfeAccounting

NOVEMBER 17, 2020

Like, literally, I paid my payroll taxes one-day late by accident, the IRS sent me a penalty for over $1,000. In addition, I didn’t know the requirements of income taxes, especially for self-employed individuals. In this post, I’m going to fully explain the difference between payroll taxes and income taxes.

CPA Practice

SEPTEMBER 20, 2023

A new work group within the Large Business and International (LB&I) division will be tasked with holding large partnerships and other pass-through businesses accountable to pay the full amount of taxes they owe, the IRS said on Wednesday.

LyfeAccounting

JUNE 25, 2021

US taxpayers pay over $1 trillion in state income taxes every year. But what if you could pay $0 in state taxes? You can pay absolutely nothing in state taxes, just by packing up your bags and moving to a tax-free state. What are State Taxes? Top 10 States With The Highest Income.

MyIRSRelief

NOVEMBER 29, 2019

According to the IRS and the US Tax Code, there are three separate taxes that constitute what a business is responsible for as far as a payroll tax to the Federal Government (IRS). The same is true of the Unemployment tax that the business must pay for each employee.

MyIRSRelief

OCTOBER 2, 2023

In addition to the accounting tasks listed above, your accountant can also help you with other important accounting tasks, such as: Preparing quarterly and annual tax returns Filing state and federal corporate income taxes Paying estimated taxes Preparing SEC filings Why Hire a Professional Accountant?

Reckon

JUNE 21, 2022

Take heed of our sound tactics to better manage your income and taxes to avoid a massive tax bill in the future. 1) Know your tax bracket and tax rates. To understand your tax rate as a sole trader business, simply use the ATO’s income tax calculator for accuracy and peace of mind.

Ronika Khanna CPA,CA

DECEMBER 12, 2024

A lack of knowledge, imperfect accounting systems and the business of running a business sometimes interfere with the timeliness of filings. One of the easiest ways to at least reduce the possibility of interest and penalties is to register for my business account with CRA and MRQ and sign up for notifications).

MazumaBusinessAccounting

DECEMBER 3, 2019

As we approach tax season, it is important to understand different types of tax forms, and why we need them. If you’re hiring a new employee, or trying to report your income tax returns, you have come to the right place! Tax forms are essential for all small businesses and must be filled out properly.

MyIRSRelief

DECEMBER 15, 2022

Our Los Angeles based tax firm , led by Mike Habib, Enrolled Agent, represents and helps business taxpayers get compliant with back years, contact us today at 1-877-78-TAXES [1-877-788-2937]. What are the benefits of accounting & bookkeeping services? What is income tax preparation service?

MyIRSRelief

JANUARY 3, 2022

The employer is legally responsible for withholding the employee’s portion of their Social Security and Medicare taxes (FICA) and their income taxes from the wages that they are paying their employees. Get tax help today by calling us at 1-877-78-TAXES [1-877-788-2937].

MazumaBusinessAccounting

MAY 31, 2022

You will need proof of payments and any business financial activity in case of disputes, identity theft, or fraud. Therefore, create a file for all banking and investment records for both your personal and business accounts. Need help organizing your business financial records? Err on the side of caution. Mazuma Can Help!

Nancy McClelland, LLC

APRIL 11, 2023

In some states, filing an extension with the IRS will automatically extend the time to complete a state income tax return. Filing an extension grants you additional time to submit your complete and accurate return, but you still need to estimate whether you will owe any taxes and pay that estimated balance by the original due date.

Ronika Khanna CPA,CA

FEBRUARY 9, 2024

However, most accounting software, will only produce a non official summary report that then has to be transcribed onto the actual form which can then be mailed. QPIP (RQAP) Boxes 7 and 8 which is the Quebec Parental Insurance Plan. The employer portion is calculated at 1.4 times the amount of the employee portion.

Ronika Khanna CPA,CA

DECEMBER 2, 2022

The T5 dividend slips are generally due by February 28th of the calendar year following the year in which the dividend was paid Although no income taxes are due at the time of filing the T5 slips with the government, interest and penalties apply for late filing. available at Amazon. You can also follow her on Facebook or Twitter .

CPA Practice

MAY 9, 2023

Assisted QuickBooks Online Accountant onboarding for accountant professionals and bookkeepers is free, via a Zoom session, and is focused on new clients who are new to QuickBooks, as well as any existing clients that aren’t actively using QuickBooks.

Ronika Khanna CPA,CA

OCTOBER 4, 2024

Before I started my own business, and despite my accounting background, I would receive a paycheque without really questioning or understanding the deductions. Once, I ventured into the arena of small business accounting, however, I had to learn how to create a paycheque and the accompanying year end slips (T4s and RL1).

CPA Practice

DECEMBER 19, 2023

As a first step, the IRS has adjusted eligible individual accounts and will make adjustments to business accounts later this month or in early January, followed by trusts, estates, and tax-exempt organizations in late February to early March 2024. 5, 2022, and Dec. 7, 2023.

Ronika Khanna CPA,CA

APRIL 26, 2024

Business tax instalment payments (including GST-QST instalments ) This means that instead of entering the data on the forms that are available via my business account at CRA and RQ and then going to your bank to make payment, either online or via mail, it can all be done at one time through one form that serves as both tax filing and payment.

LyfeAccounting

JULY 11, 2021

So in this post, we’re going to discuss what the foreign tax credit is, break it down so we can easily understand it, and determine how to qualify for it. What is a Foreign Tax Credit? So technically, it is a non-refundable tax credit for income taxes paid to a foreign government as a result of foreign income tax withholdings.

Ronika Khanna CPA,CA

APRIL 25, 2025

If you are an unincorporated sole proprietor or a partnership, you are required to fill out the statement of business activities (T2125) on your personal tax return also referred to as the T1. If you have set up a Canadian corporation, then you are required to complete a corporate income tax return referred to as a T2.

CPA Practice

MAY 15, 2024

The awards also let professionals see the technologies and best workflow practices their peers are using, which can help them stay competitive in the constantly-evolving tax and accounting space. Small Business Accounting – Installed Programs WINNER: Intuit QuickBooks Desktop (83.7%) Runners Up: PC Software Accounting Inc.

CPA Practice

APRIL 17, 2023

And now, the results are in: IN-FIRM TECHNOLOGIES Federal/State Income Tax Preparation Insight : As was true in every year of voting, the tax prep system category is always the most voted-on, with nearly all respondents selecting a preferred system. We thank the more than 5,000 professionals who participated in voting this year.

ThomsonReuters

DECEMBER 19, 2023

By allowing taxpayers to subtract a certain percentage of their qualified expenditures on renewable energy systems from their federal income taxes, renewable energy tax credits result in a reduction of tax liability, thus making sustainable choices more financially appealing to individuals and businesses.

inDinero Tax Tips

JUNE 12, 2023

One of the most common problems for startup founders is the commingling of funds: when you pay for personal transactions from a business account, or visa versa. You’ll reimburse yourself if you’ve used personal accounts to pay for business expenses. This process will result in taxable income to the shareholder.

xendoo

JUNE 25, 2021

Without fail, it will cause more problems than it solves, including inaccurate books, tax mistakes, and cash flow issues. . Real estate accounting shouldn’t be complicated, and this is one of the golden rules that can keep things simple—don’t make personal purchases with business accounts. Fool-Proof Accounts Receivable.

xendoo

FEBRUARY 15, 2022

If your situation requires specialized knowledge about tax codes, fees are usually commensurate with qualifications. What Does a Tax Consultant Do? A tax consultant is trained in tax law and financial accounting. They also should know recent tax law changes on both a federal and state level. .

Ronika Khanna CPA,CA

MARCH 24, 2022

The space designated as your home office is used to earn business income and/or you meet clients or customers on a regular basis. For example, you cannot deduct expenses relating to the workspace in your garage which is used for home improvement projects from which you do not earn income.

Snyder

JUNE 20, 2022

So for a small business owner, it’s vital to understand accounting so they can understand their business and also be able to communicate with banks and investors. What is small business accounting? Basic steps in accounting for small businesses. Open a business bank account.

inDinero Tax Tips

MARCH 3, 2021

Using your entity type, you can identify your deadline for filing business income taxes and what it would be if you elect to take advantage of the extension, which needs to be filed before the original tax deadline date. May 15 is a Sunday, so the deadline will be the next business day, which is Monday, May 17, 2021.

LyfeAccounting

APRIL 27, 2021

But as a CPA who prepared at least hundreds of returns, we can tell you that a tax refund is usually the result of a mistake. A tax refund is a refund of the taxes you OVER paid. So in actuality, you paid more in income taxes than was necessary by law. The Child Tax Credit or CTC. Earned Income Tax Credit.

LyfeAccounting

JULY 12, 2021

Income is considered passive if the income is derived from a business you do not actively participate in during the year. Or, if the income is derived from rental activities, aka owning rental property. Be sure not to confuse Income tax and self-employment tax for being the same thing.

LyfeAccounting

OCTOBER 29, 2020

The first way you may be taxed on a stock is if you sell a stock or security for a gain. If you sell an investment that you held for less than a year, you will pay short-term capital gains tax. The short-term capital gains tax rate equals your ordinary income tax rate – your tax bracket.

Ronika Khanna CPA,CA

MAY 26, 2023

Some of the information that can be found on a notice of assessment includes: Personal income tax returns (including small business tax returns on a T2125 ): Summary of the income tax return that was filed which includes certain key line items such as total income, deductions and credits , and final tax amount payable or refund.

Ronika Khanna CPA,CA

NOVEMBER 3, 2023

Similar to the federal registration there are three options for registering a payroll number with Revenue Quebec: ONLINE: If you already have a business number, you should register for a Clic Sequr (My Business Account) with Revenue Quebec. Simply click on this option and follow the instructions.

LyfeAccounting

DECEMBER 30, 2020

Are you tired of paying taxes? Taxes stink. But recently, I heard that some people pay very little in taxes. In fact, the president’s tax returns show he paid just $750 in federal income taxes in 2016 and 2017. This helps make the tax system fair. How to Calculate Your Taxes. INCOME TAXED.

LyfeAccounting

JUNE 7, 2021

Did you know that some countries have zero income taxes? If you use places like Dubai, Monaco, or the Bahamas as your primary residence then you don’t have to pay any taxes. Well, there are other states that give you great tax benefits as well. Not into changing your citizenship? Tip #4: Make Charitable Donations.

LyfeAccounting

JULY 22, 2021

Hawaii also has the second-highest income tax in the country coming in at 11%. That’s 11 times more than other states like F lorida and Texas who virtually have no income tax at all. Nevada’s effective property tax rate is just 0.6% Well, it’s possible because of tourism taxes.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content