How To Make IL Dept Of Rev (IDOR) Business Tax And Extension Payments Online – UPDATED April 2025

Nancy McClelland, LLC

APRIL 8, 2025

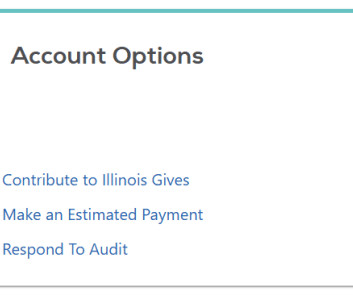

Did your accountant (possibly me) ask you to make a business tax payment for your Illinois pass-through entity, such as a Partnership or S-Corp — maybe an estimated tax payment or extension payment? On the Summary tab, look for the Business Income Tax section. (In Go to the “Summary” tab.

Let's personalize your content