A Breakdown of the Colorado Occupational Privilege Taxes

Patriot Software

OCTOBER 13, 2022

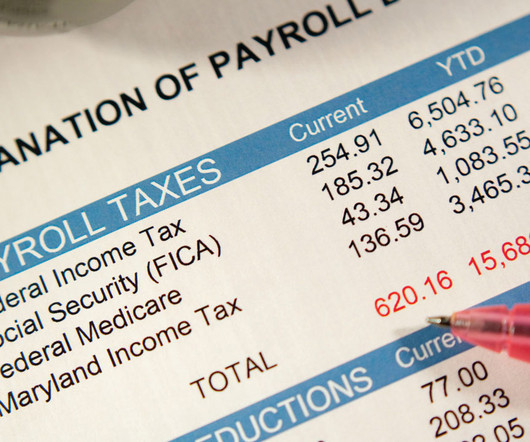

A handful of cities in Colorado have a local tax called an occupational privilege tax. If you’re an employer in Colorado, it’s important to know if you owe the occupational privilege tax and what your city requirements are. What is occupational privilege tax? Both employees and employers owe it.

Let's personalize your content