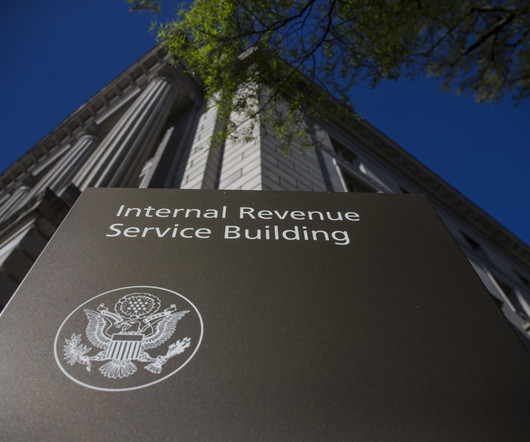

Tax Court Case Shows IRS Effort to Revoke Passports for Tax Debt

CPA Practice

AUGUST 29, 2023

By Ken Berry, J.D. If you’re planning to take a trip out of the country, make sure that your tax obligations have been paid up. Otherwise, as shown in a new case, Belton, TC Memo 2023-13, 1/24/23 , the IRS might try to revoke your passport. Background : Under a little-noticed spending measure enacted in 2015, the Fixing America’s Surface Transportation (FAST) Act, the IRS can deny, revoke or limit a passport if you have a seriously delinquent tax debt exceeding $50,000, barring a special excepti

Let's personalize your content