How Virtual Bookkeeping Can Help You Clean Up Your Messy Books

IgniteSpot

MARCH 7, 2023

Bad bookkeeping is bad for business because.

IgniteSpot

MARCH 7, 2023

Bad bookkeeping is bad for business because.

CPA Practice

MARCH 7, 2023

By Gail Cole. The Uniform Certified Public Accountant Examination (CPA Exam) is regularly updated to reflect enhancements to accounting and auditing standards as well as tax laws and regulations — and to improve the efficiency of the exam. The next update goes into effect January 1, 2024 , and places new emphasis on the role of emerging technology in delivering accounting services.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TaxConnex

MARCH 7, 2023

Online retailers and eCommerce companies have been the focal point of taxing jurisdictions and their updated nexus laws for years. Our third annual survey of financial professionals revealed a sales tax storm in many industries. Financial leaders continue to lean on internal resources while wrestling with the current economy, inflation and a tight job market.

BurklandAssociates

MARCH 7, 2023

The deferred revenue schedule is an important tool to manage cash flow and ensure your startup's financial statements accurately reflect its position. The post Deferred Revenue Schedule for Startups appeared first on Burkland.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

MARCH 7, 2023

By Nellie Akalp. There are many reasons for your clients to claim an S Corp election. Although the most significant advantage is the limited liability protection it provides its shareholders, the S Corp election also avoids the double taxation incurred by C Corps. Milestones to Consider At specific points in their growth trajectory, your clients may reach some milestones that could call for a change in their current business structure.

Xero

MARCH 7, 2023

Did you know there are two versions of invoicing in Xero? There’s the original ‘classic’ invoicing experience and ‘new’ invoicing. New invoicing is the updated version with a refreshed design, new functionality and many of the features you know and love from classic. New invoicing has come a long way since its initial launch and we’re pleased to have introduced several improvements you won’t see in classic invoicing.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Xero

MARCH 7, 2023

Our research found that recruitment is one of the main challenges facing accountants at the moment, so we’re shining a light on some amazing accountants to bust misconceptions around the industry. We speak with Alex Beattie, managing director of KRW Accountants and rifleman in the army reserves, and Hilary Dyson, founder of Bridge Financials and opera singer.

CPA Practice

MARCH 7, 2023

You were proactive and diligent about readying your accounting firm for tax season, and yet you’re still facing staffing gaps precisely when you need all hands on deck. You’d like to hire some new employees, but your search for viable candidates isn’t yielding the results you’d hoped for. Know that you’re not alone in your recruitment struggles: research for Robert Half’s 2022 Demand For Skilled Talent report found that 87% of finance and accounting managers are challenged in finding skilled pro

Insightful Accountant

MARCH 7, 2023

Go Beyond's Greg Sloan discusses why outlining your company's purpose is essential to attracting your ideal workforce.

Xero

MARCH 7, 2023

Today, Wednesday 8 March, is International Women’s Day. I’m taking a moment today to reflect on Xero’s progress towards our diversity, inclusion and belonging goals, and to think about what we can do to continue to evolve them. This year, the UN Women International Women’s Day theme is ‘DigitALL: Innovation and technology for gender equality’. The theme seems particularly relevant to Xero this year, as a technology company working hard to enable equal opportunities for not only our women employe

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Insightful Accountant

MARCH 7, 2023

It's time for QB Talks, and this month, that means the 'QBO Update' with Liz Scott.

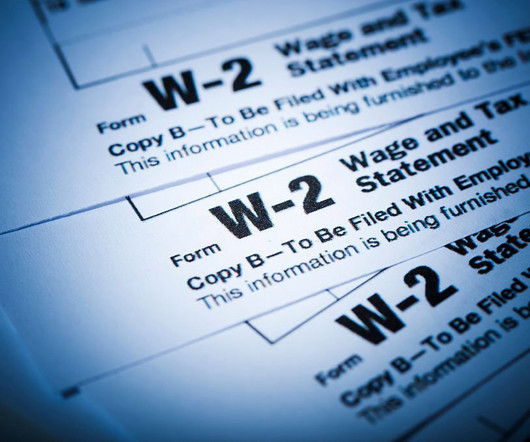

CPA Practice

MARCH 7, 2023

By Leada Gore, al.com (TNS) The IRS is urging people to avoid scams currently making the rounds on social media. One of the schemes, according to the IRS, encourages people to use tax software to manually fill out their W-2 form and provide false income information. This scheme suggests people make up a large salary and witholdings from a phony employer in an effort to get a large refund, sometimes as much as five figures.

GrowthForceBlog

MARCH 7, 2023

7 min read When you picture a leader, you probably conjure up images of generals charging into battle ahead of their soldiers.

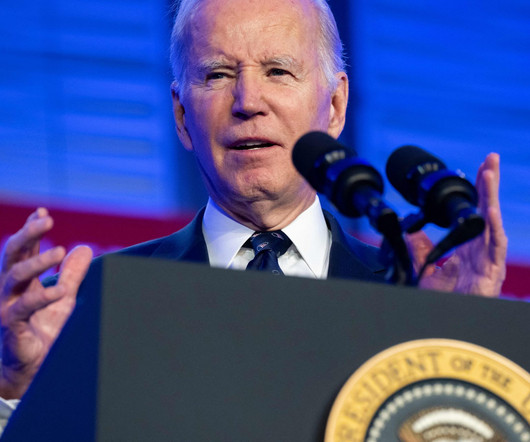

CPA Practice

MARCH 7, 2023

By Justin Sink and Josh Wingrove, Bloomberg News (TNS) President Joe Biden’s budget will propose hiking payroll taxes on Americans making over $400,000 per year and allowing the government new power to negotiate drug prices as part of an effort the White House says will extend the solvency of a key Medicare program for another quarter century. “The budget I am releasing this week will make the Medicare trust fund solvent beyond 2050 without cutting a penny in benefits,” Biden said Tuesday in an

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

AccountingDepartment

MARCH 7, 2023

As an entrepreneur or manager/owner of a busy small to medium-sized enterprise, it’s essential that you use tools to automate as many processes as feasible to keep things running smoothly. You can do less with more when you pick the right kind of technology and software solutions.

Patriot Software

MARCH 7, 2023

Have you heard about the Service Industry Tip Compliance Agreement program, otherwise known as SITCA? On February 6, the IRS released a proposed revenue procedure—Notice 2023-13—establishing SITCA. Learn what it is and why it matters to service industry employers.

Accounting Insight

MARCH 7, 2023

Who will be the Top 50 Women in Accounting for 2023? Globally, the accounting industry witnesses remarkable achievements by women every year. A passion for driving industry change and innovation can be seen not only in the indelible mark these women make, but also in how they inspire others with their resilience, leadership, mentorship, and active participation in a more diverse and inclusive industry.

CPA Practice

MARCH 7, 2023

A new partnership between the world’s most influential association for the accountancy profession and the world’s most prestigious university will equip finance professionals with the tools and knowledge to make businesses more sustainable. AICPA & CIMA, which together form the Association of International Certified Professional Accountants, and the University of Oxford’s Saïd Business School, will jointly offer a new executive management program in sustainability for accounting and finance

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Insightful Accountant

MARCH 7, 2023

The partnership enables best-in-class invoice-to-pay solution to more credit union customers.

Nancy McClelland, LLC

MARCH 7, 2023

(c) Nataliya Vaitkevich The past three years have been challenging in so many ways, to so many people — but as a tax preparer, I can confidently say that the inability for the IRS to provide its usual level of customer service has been among the most impactful. Luckily, recent Congressional funding to make up for years of inadequate budgets, combined with Treasury Secretary Yellen’s direction that IRS priorities should include clearing the backlog of unprocessed tax returns and impro

Insightful Accountant

MARCH 7, 2023

See how the online document management solution and an integrated file sharing platform automates document workflows for today's accounting professionals.

Dent Moses

MARCH 7, 2023

The Inflation Reduction Act provides nearly $80 billion in IRS funding over the next ten years. The IRS plans to use some of the funds to hire 87,000 employees. Many claim the funds will be used to hire an army of auditors dedicated to auditing taxpayers. Let’s add some perspective to the claims and numbers: The IRS workforce is aging like the rest of the workforce.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Insightful Accountant

MARCH 7, 2023

Check out how the platform auto-detects and flags your bookkeeping errors based on past trends and historical analysis.

CPA Practice

MARCH 7, 2023

BPM LLP , one of the nation’s top 40 largest public accounting and advisory firms, and Dale Carnegie Training, a leading professional development organization, have partnered together to deliver a transformational experience to BPM’s network of clients throughout the United States. The corporate training solutions provided through this partnership augment BPM’s HR consulting team’s breadth of current training programs.

Inform Accounting

MARCH 7, 2023

The new penalties will impact businesses who submit their VAT returns or pay their VAT late. The first monthly returns and payments affected by the penalties are due by 7 March 2023. The late payment penalties and points-based late submission penalties were introduced from 1 January 2023, replacing the VAT default surcharge, and apply to accounting periods which start on or after that date.

CPA Practice

MARCH 7, 2023

By Mike Piershale, ChFC, Kiplinger Consumer News Service (TNS) A safe harbor 401(k) is a great way for small business owners to reward employees and keep them happy by making generous retirement contributions on their behalf that are immediately vested. And business owners know that finding and keeping good employees is one of the keys to increasing profits.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

CalCPA

MARCH 7, 2023

The CalCPA Nominations Committee submitted the following proposed nominated slate for CalCPA’s top spots: Chair: Meredith A. Johnson (San Francisco Chapter) First Vice. The post CalCPA BUZZ: Leadership Nominated Slate for 2023-24 appeared first on Hot Topics.

CPA Practice

MARCH 7, 2023

By Lindsey Raker. While you focus on your business, we stay on top of legislative and policy changes that can affect your tax compliance. Nuts and bolts Closing the door on transaction thresholds? How do you know if your business is required to register for sales tax in another state? In many states, all it takes is meeting a transaction threshold.

Cherry Bekaert

MARCH 7, 2023

With the end of 2022, government contractors are starting their year-end close outs, thinking and reviewing costs, while considering Federal Acquisition Regulation (FAR) allowability and the potential tax implications. In this article, we address some of the frequently asked questions regarding payments of certain items that benefit employees. Candidate Recruitment Recruiting costs for the right candidate for your business can really add up.

Anders CPA

MARCH 7, 2023

Do banks qualify for the Employee Retention Tax Credit, often referred to as the ERTC or ERC? The answer is complicated due to the nature of ERTC qualification requirements. Some financial institutions are being bombarded with emails and calls from consultants promising them hefty sums of the ERTC funds, so it’s important to take the time to refresh yourself on which qualifications a business requires to apply for the ERTC before taking them up on that offer.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content