Art of Accounting: Providing advice to a non-client

Accounting Today

AUGUST 7, 2023

Acquaintances who want quick, off-the-cuff advice from an accountant about important financial decisions are doing themselves a disservice.

Accounting Today

AUGUST 7, 2023

Acquaintances who want quick, off-the-cuff advice from an accountant about important financial decisions are doing themselves a disservice.

Xero

AUGUST 7, 2023

Xerocon Sydney is just weeks away on 23 and 24 August, and the ICC exhibitor floor will be full to the brim with some of the best and most loved apps, tools and services for accountants, bookkeepers and small businesses. This year, you can expect to see 80+ exhibitors at the event, including more than 70 leading Xero App Store app partners. Whether you’re looking for tools to chase invoice payments, simplify tax compliance, or make job management easier, you’ll find plenty of solutions to help s

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

AUGUST 7, 2023

By Deloitte. Environmental, social, and governance (ESG) considerations continue to transform today’s financial landscape as many companies are taking meaningful steps toward enhancing sustainability disclosures, and as a result seeing long-term business benefits. Beyond adhering to regulatory requirements, integrating ESG into overall corporate strategy can create business value, and companies across sectors are recognizing the opportunity to contribute to a more sustainable future.

Accounting Today

AUGUST 7, 2023

The American Institute of CPAs and the National Association of State Boards of Accountancy are pilot testing a program to make it easier for accounting students to earn 150 credit hours.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Canopy Accounting

AUGUST 7, 2023

When it comes to preparing a tax return, the most crucial decision is determining the client's filing status. There are five different filing statuses: single, married filing jointly, married filing separately, head of household, and qualified surviving spouse. It's worth noting that the IRS recently changed the designation from "qualifying widow or widower" to "qualified surviving spouse.

Accounting Today

AUGUST 7, 2023

Given artificial intelligence's ability to "hallucinate," accounting firms need to place rules around how staff use these tools.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Cherry Bekaert

AUGUST 7, 2023

As technology and business leaders seek efficiencies in nearly every aspect of their business, they need solutions to help them save costs and to make informed decisions quickly. In the second episode of our “Year of Efficiency” podcast series, Jerry Hereden hosts Tertius Eksteen , Senior Manager, and Pamela Butler , Manager, from Cherry Bekaert’s Digital Advisory Services group to discuss how some technology companies are optimizing their business while on a Digital Transformation journey.

CPA Practice

AUGUST 7, 2023

By Christopher Wood, CPP. During a presentation at PayrollOrg’s annual Congress event, the founder of a human capital management advisory business assured payroll professionals that artificial intelligence will not replace their profession but instead transform it into a more collaborative process within a business. About halfway through his presentation on the future of payroll at Payroll Org’s (formerly the American Payroll Association) annual Congress event, Pete Tiliakos, an analyst and foun

Reckon

AUGUST 7, 2023

Tired of success? Sick to the back teeth with all talk of stability and strong cash flow? Dreading strong growth, healthy profits, and excellent brand recognition? Then listen up! It’s time to run your business right into the dirt. It’s easy, let’s get you started. 1) Ignore reporting One of the best ways to ruin your business beyond repair is to ignore reporting.

CPA Practice

AUGUST 7, 2023

By Alan Hartwell. With the year halfway over and tax season behind us, it’s a valuable time for CPAs to evaluate their current technology and review what could make a difference to their firm and client base. Already this year, firms have faced a shortage of staff and an increase in client demands as accountants are expected to do more than ever for clients.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Cherry Bekaert

AUGUST 7, 2023

New rules cover disclosure of cyber incidents on cybersecurity risk management, strategy and governance by public companies On July 26, 2023, the Securities and Exchange Commission (SEC) adopted the Cybersecurity Reporting Requirements that were proposed in March 2022 to provide transparency and protection to investors. The new regulations will become effective 30 days after publication of the adopting release in the Federal Register and will require public companies to disclose any material cyb

CPA Practice

AUGUST 7, 2023

The Treasury Department and the IRS said on Aug. 4 that proposed regulations are on the way regarding a new excise tax established by section 5000D of the Internal Revenue Code. In Notice 2023-52 , issued on Friday, the IRS proposed that the forthcoming regulations will provide: Rules on the scope of sales subject to the section 5000D tax; Rules regarding the taxable sale price; and Procedural rules intended to help taxpayers meet their reporting and payment obligations with respect to the tax.

Accounting Today

AUGUST 7, 2023

Paxos will publish a third-party attestation by an accounting firm on PYUSD's reserve assets.

Insightful Accountant

AUGUST 7, 2023

Insightful Accountant's YouTube page is your first stop for all videos, including webinar archives and podcasts. Check it out and subscribe today!

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Going Concern

AUGUST 7, 2023

PwC UK is following through on its threat to force “lockdown-damaged” interns into the office so they can learn how to interact with human beings face-to-face, reported The Times this morning. Three summers have passed since the pandemic first forced everyone inside, this summer is the first year since that the firm is making a conscious effort to ditch Zoom and get the newbies in a room with their colleagues.

CPA Practice

AUGUST 7, 2023

Justworks, a benefits, payroll and HR technology provider, has launched Expenses, an expense management tool that Justworks PEO customers can use to process expense reimbursement requests alongside payroll. Expenses consolidates tools and minimizes the risk of error when reimbursing employees for out of pocket expenses. Administrators can set up approval workflows and custom rules, providing structure for employees and simplifying the reconciliation process for accountants.

Insightful Accountant

AUGUST 7, 2023

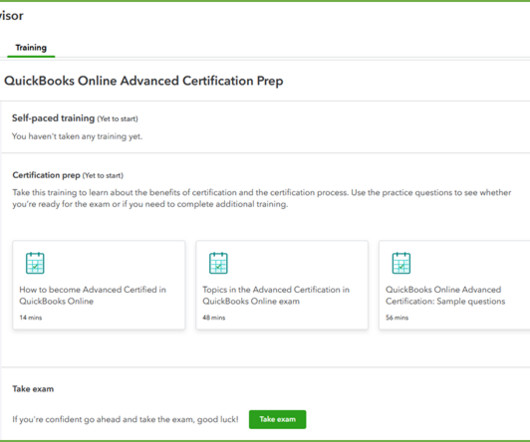

In Part 7 of Murph's Clues about the Top 2024 Process, he examines the 2023 stats related to QuickBooks Online Advanced Certification.

Accounting Today

AUGUST 7, 2023

The service may revive the extra payments it provided to employees in 2020 to coax them back to the office, according to a new report.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Insightful Accountant

AUGUST 7, 2023

Xero Economist Louise Southall dives into what the latest Xero Small Business Insights report means to you.

Inform Accounting

AUGUST 7, 2023

HMRC is aware of a phishing campaign telling customers they can claim for the fourth Self-Employment Income Support Scheme (SEISS) grant as support during the coronavirus pandemic.

Insightful Accountant

AUGUST 7, 2023

Hour Timesheet and Clockwise co-founder Debbie Sabin discusses the Top 3 things civil engineer firms look for when selecting a timesheet software vendor.

CPA Practice

AUGUST 7, 2023

Nearly 700 employees at The Bonadio Group participated in community service activities today during the firm’s sixth annual Purpose Day, benefitting more than 30 non-profit organizations. Purpose Day was created to provide staff with opportunities to give back to their communities in the spirit of the company’s Bonadio Purpose. All the firm’s offices were closed to provide each employee with the opportunity to spend the day volunteering.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Insightful Accountant

AUGUST 7, 2023

Insightful Accountant's Gary DeHart and Xero US' Ben Richmond discuss what it takes to become a true advisor for your clients, and much more. Check out this edition of Accounting Insiders.

CPA Practice

AUGUST 7, 2023

The American Institute of CPAs (AICPA) and National Association of State Boards of Accountancy (NASBA) will launch an innovative post-graduate program this fall in collaboration with the Tulane School of Professional Advancement (SoPA). The program blends rigorous online learning with on-the-job professional experience for college accounting graduates, offering a less costly and more flexible way to complete the 150-hour course credit requirement to become a licensed CPA.

Accounting Today

AUGUST 7, 2023

An Israeli startup that's advised by former IRS officials is using artificial intelligence to fight financial crimes.

CPA Practice

AUGUST 7, 2023

The accounting software and payroll services provider, Patriot Software, has processed over $13 billion in payroll and payroll tax dollars since 2018, a milestone for the SaaS developer says it hit in June 2023. Patriot’s payroll has the largest adoption rate among its software products, serving businesses with one to 500 employees in most industries.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

LSLCPAs

AUGUST 7, 2023

While outsourcing has become a solution for businesses looking to streamline operations, reduce costs, and improve efficiency, some companies fear they will miss out on some important financial details if their accounting is not under their roof. However, several areas in the accounting space are better when they’re outsourced to firms that only do accounting.

CPA Practice

AUGUST 7, 2023

The IRS and the Treasury Department issued proposed regulations on Aug. 3 that identify certain monetized installment sale deals as listed transactions—a reportable transaction that is the same as, or substantially similar to, a transaction specifically identified by the IRS as a tax avoidance scheme. As such, participants and material advisors in a monetized installment sale transaction would be required to file disclosures with the IRS.

Withum

AUGUST 7, 2023

Learn everything you need to know about the Commercial Clean Vehicle Credit, an incentive program promoting environmentally-friendly commercial vehicles. The Commercial Clean Vehicle Credit provides a maximum federal income tax credit of $7,500 or $40,000 (if the gross vehicle weight is 14,000 pounds or above). Unlike the personal clean vehicle credit, there are no battery or critical mineral component requirements and final assembly does not have to occur in the United States.

VJM Global

AUGUST 7, 2023

In line with recommendations made by the GST Council in its 50th GST Council meeting , CBIC has issued circulars to clarify on various issues suggested by the GST Council such as taxability of services provided by one office to another office within same organization and manner of valuation, e-invoices of supplies made to government entities, applicability of GST on shares held by holding company for its subsidiary company.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content