Georgia passes CPA licensure changes bill

Accounting Today

APRIL 7, 2025

Legislation providing two pathways to a CPA license unanimously passed both chambers in the Georgia General Assembly and is awaiting the governor's signature.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Georgia Related Topics

Georgia Related Topics

CPA Practice

JUNE 9, 2024

Rosie Manins, The Atlanta Journal-Constitution (via TNS) The trade association for online marketplaces including Google, Amazon and eBay is trying to void a new Georgia law that extends requirements for collecting seller information, alleging it will hurt Georgia businesses. It’s unclear to us why Georgia decided to go down this path.”

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Data Talks, CFOs Listen: Why Analytics Are Key To Better Spend Management

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

CPA Practice

DECEMBER 3, 2024

Staff reports The Albany Herald, Ga. TNS) ATHENS, GA (Nov. 27)—A tax preparer who admitted to filing more than $3 million in fraudulent tax returns on behalf of her clients is facing up to 30 years in prison for her crime.

Data Talks, CFOs Listen: Why Analytics Are Key To Better Spend Management

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Cherry Bekaert

JUNE 9, 2023

Contributors : Chris Grimes, Senior Manager, State & Local Tax | Peter Baisch, Senior Manager, State & Local Tax Georgia IRC Conformity and Section 174 On May 2, 2023, Georgia Senate Bill 56 was signed into law, which updated Georgia’s Internal Revenue Code (IRC) conformity date from January 1, 2022, to January 1, 2023.

CPA Practice

AUGUST 30, 2023

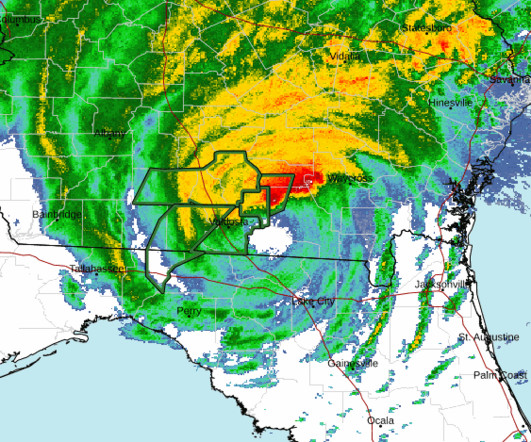

As of noon Eastern time, the hurricane was still a Category 1, and moving over southern Georgia. link] Hurricane and tropical storm warnings are now posted for most of the southern part of Georgia, as well as parts of South and North Carolina, where “significant storm surge will continue,” the agency stated.

CPA Practice

SEPTEMBER 12, 2024

Marking its 11th anniversary, the 2024 Georgia Accounting Food Fight has concluded with resounding success, further cementing its commitment to ending hunger across the state. It provides critically needed resources to Feeding Georgia food banks.” Fundraisers like the Georgia Accounting Food Fight are more crucial than ever.

TaxConnex

JANUARY 19, 2023

The wording of the Georgia Department of Revenue offers a guide to what states expect: “An individual can be liable for the unpaid taxes of a business. Question of will Just as economic nexus and taxability are not the same in every state, personal responsibility laws also differ.

CPA Practice

SEPTEMBER 13, 2023

The Internal Revenue Service today announced tax relief for individuals and businesses affected by Idalia in 28 of the state’s 159 counties in Georgia. These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

TaxConnex

DECEMBER 12, 2023

For example, in Georgia : “An individual can be liable for the unpaid taxes of a business. When a business fails to pay the taxes it has collected or should have collected to the Georgia Department of Revenue, the Department sends an assessment notice to the person it has identified as responsible for payment.

CPA Practice

APRIL 8, 2025

This legislation introduces significant reforms to the CPA licensure process and broadens practice privilege mobility, reflecting Georgia's commitment to a dynamic and accessible accounting profession.

Accounting Today

SEPTEMBER 13, 2023

The IRS is pushing back filing and payment deadlines for those impacted by the storm.

CPA Practice

JANUARY 31, 2023

More than 100 members of The Georgia Society of Certified Public Accountants (GSCPA) recently met at the state Capitol to share their thoughts on important issues facing the accounting profession with their elected officials. Chairman David Knight and each member of the Georgia CPA Caucus: Chairman John Carson, Rep.

TaxConnex

DECEMBER 28, 2023

For example, in Georgia effective this Jan. 1 sales of specified digital products, goods and codes sold to an end user in the state are subject to Georgia sales and use tax. Specified digital products” means digital audio-visual works, digital audio works or digital books.

TaxConnex

SEPTEMBER 10, 2024

The lowest state-level sales tax (aside from the NOMADs) is in Colorado, Alabama, Georgia, Hawaii, New York and Wyoming. The highest state-level rates are in California, Indiana, Mississippi, Rhode Island and Tennessee.

TaxConnex

NOVEMBER 2, 2021

In Arkansas, Arizona, Georgia and other states, these products are simply not considered “food” and are generally taxable. On the flip side, obvious candy coating on a nutrition bar doesn’t matter and the product is still considered a tax-exempt dietary supplement in Florida. Sometimes the label doesn’t matter at all.

TaxConnex

JULY 12, 2022

Georgia has amended the exemption from sales and use tax on the sale or lease of computer equipment to be used by qualifying Georgia high-tech companies. The legislation extends the sunset date for this exemption to Dec. 1, 2024.

CPA Practice

NOVEMBER 14, 2024

The agency has also been honored with awards from other reputable brands including The Recorder (California), Daily Report (Georgia), Texas Lawyer, National Law Journal (Midwest and Washington, DC), New Jersey Law Journal, New York Law Journal and Connecticut Law Tribune (New England). “We

TaxConnex

FEBRUARY 8, 2024

In Georgia now, sales of specified digital products, goods and codes sold to an end user in the state are now subject to the state’s sales and use tax under certain conditions. Tracking your sales tax obligations on food is especially tricky as a galaxy of conditions – does the food contain sugar or chocolate? is it grown locally?

CPA Practice

SEPTEMBER 14, 2023

Marking its 10th anniversary, the 2023 Georgia Accounting Food Fight has concluded with resounding success, further cementing its commitment to ending hunger across the state. Through our Food Fight initiative, CPAs raised $347,537, ensuring food security for many across Georgia. million meals. million meals.

Insightful Accountant

APRIL 8, 2025

Georgia has passed legislation creating two new pathways of eligibility for candidates to sit for the CPA examination. These new paths are in addition to the existing traditional requirements.

TaxConnex

JANUARY 5, 2021

States like Georgia, will accept the retailer’s home state resale exemption certificate while California requires a California resale exemption certificate. States similar to California present a challenge as the only way to provide a valid resale exemption certificate is to register for sales tax purposes in the state.

CPA Practice

MARCH 26, 2025

has acquired Taylor CPA & Associates, a firm with offices in Columbus and Atlanta in Georgia. Houston-based McConnell Jones, the largest majority African American-owned and controlled public accounting firm in the U.S.,

Withum

AUGUST 14, 2024

On August 9, 2024, the IRS announced relief from certain tax filing and payment deadlines for individuals and businesses in all of South Carolina, most of Florida and North Carolina, and part of Georgia that were affected by Hurricane Debby.

TaxConnex

DECEMBER 5, 2023

In recent years IHRSA lent its voice to prevent imposition of sales taxes on health club memberships in Maine, Pennsylvania, West Virginia, Wyoming, Georgia and Arizona. Instead, policymakers should be actively encouraging physical activity,” the organization contends.

TaxConnex

AUGUST 23, 2022

We are excited to announce that we have been chosen by the Georgia Society of CPAs to speak at two events this fall and exhibit at this week’s Southeastern Accounting Show ! “We The Southeastern Accounting Show is this week (August 24-25) at the Cobb Galleria in Atlanta, Georgia.

Accounting Today

SEPTEMBER 13, 2024

Plus, CohnReznick expands its valuation practice, Herbein adds a director of business development, and Abdo and Mercadien each announce a wave of promotions.

TaxConnex

FEBRUARY 25, 2021

A number of states - including Colorado, Georgia, Pennsylvania and Washington and more - have chosen to offer remote sellers the option of complying with strict use tax notification and reporting requirements rather than registering for sales tax under nexus provisions. Use tax or sales tax is due on a sale, but not both.

Accounting Today

OCTOBER 31, 2024

The Georgia accountants were sentenced to periods of supervised release and have to pay millions in restitution.

TaxConnex

AUGUST 24, 2021

If you are selling through a marketplace, the majority of states now have these laws in place, including, recently , Georgia, Florida, Hawaii, Wisconsin, Illinois, Michigan, South Carolina and North Carolina. Devil in the details.

TaxConnex

OCTOBER 7, 2021

In Georgia , tax collections were up 12.7% The growth rate for all Tennessee taxes in August was 22.11 Sales tax revenues and state corporate tax receipts (franchise and excise taxes) both posted substantial growth. in August year over year. The gross sales tax take finished 15.9% over August 2020; income tax collections were up 13.9%.

CPA Practice

OCTOBER 2, 2024

Gorowitz Accounting & Tax Services has acquired fellow Georgia CPA firm Reed, Quinn & McClure. Alpharetta, GA-based CPA and business advisory firm S.J. Financial terms of the deal weren’t disclosed. According to S.J.

CPA Practice

DECEMBER 22, 2023

A Georgia man was sentenced on December 19 to two years in prison for evading his personal federal income taxes. In 2015, Patel purchased a franchise of the business in Claxton, Georgia. In 2015, Patel purchased a franchise of the business in Claxton, Georgia. million in income – including almost $1.18 Attorney Jill E.

Going Concern

DECEMBER 9, 2022

In Georgia, audit managers and tax managers are expected to see salaries rise 22.2%, while tax directors are projected to have a bump in pay between 7.1% Georgia: $50,000-$75,000. Georgia: $65,000-$95,000. Georgia: $110,000-$150,000. Georgia: $150,000-$200,000. Georgia: $60,000-$75,000. DMV: $55,000-$70,000.

TaxConnex

MAY 26, 2022

Georgia, where TaxConnex is headquartered, allows for an out-of-state resale exemption certificate in this situation. There are approximately 10-15 states that operate similar to Illinois; however, many states will allow an out-of-state resale exemption certificate in a drop shipment transaction. Resale Exemption Certificates.

TaxConnex

MAY 27, 2021

Alabama, California, Connecticut, Georgia and New York offer a half-dozen or more. A glance at the number and variety of tax exemption forms for resale shows that some states might be simpler to deal with than others. Idaho and Pennsylvania, for instance, usually require one form. Texas offers nine different forms.

TaxConnex

DECEMBER 30, 2021

Other jurisdictions were pursuing similar efforts: Georgia and Connecticut seemed first in line. By March, it had greenlighted the country’s first tax on digital advertisements. Estimates reportedly said the tax will generate up to $250 million.

Accounting Today

MARCH 25, 2025

McConnell Jones, the largest African American-owned CPA firm, is focused on expanding its geographic footprint as part of its growth strategy.

PYMNTS

AUGUST 7, 2020

District Court for the Northern District of Georgia with fraudulently obtaining more than $4 million in PPP loans. The accused include Darrell Thomas, 34, of Johns Creek, Georgia; Andre Lee Gaines, 66, of Dallas, Georgia; Kahlil Gibran Green Sr., Rabbitt of the Justice Department’s Criminal Division. Justice Department.

TaxConnex

DECEMBER 7, 2023

In Georgia , effective this Jan. State updates California has expanded its sales and use tax exemption for new, used or remanufactured trucks and new or remanufactured trailers or semitrailers delivered to a purchaser in state for use in interstate commerce to include used trailers or semitrailers.

DentalAccounting

APRIL 13, 2020

To support his dental clients, Lee is also a member of the Dental Accounting Association , Certified Tax Coach (CTC) and Georgia Society of Certified Public Accountants. Lee has operated his own CPA practice for over twenty years. Previously, Lee worked for Southern Company.

CPA Practice

OCTOBER 1, 2024

The IRS on Tuesday announced disaster tax relief for all individuals and businesses affected by Hurricane Helene, including the entire states of Alabama, Georgia, North Carolina, and South Carolina, as well as parts of Florida, Tennessee, and Virginia. 24 in Georgia; Sept. 22, 2024, in Alabama; Sept. 23 in Florida; Sept.

TaxConnex

APRIL 6, 2021

Georgia lawmakers have introduced H.B. 594 , which would impose the Georgia sales tax on digital goods or services. Municipalities in Alaska, which has no statewide sales tax, have begun banding together to impose tax on remote online sales into their jurisdictions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content