Year-End Moves for Flexible Spending Accounts

CPA Practice

SEPTEMBER 8, 2023

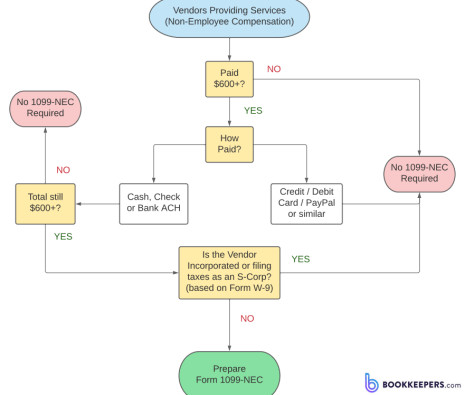

Similarly, the employer saves on its share of payroll taxes. There are two main types of accounts: healthcare FSAs and dependent care FSAs. Healthcare FSAs: After amounts are deposited in your account, you may use the money throughout the year to pay for qualified healthcare expenses as needed.

Let's personalize your content