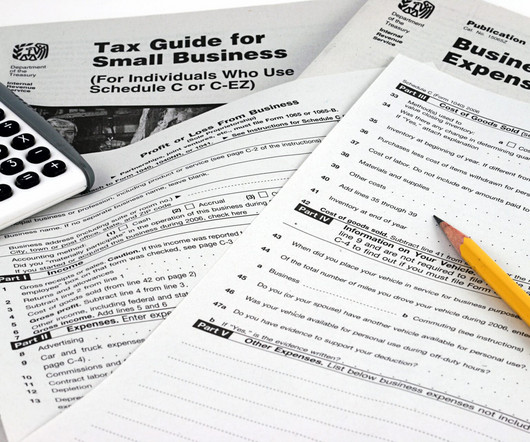

Drive Down Your Business Taxes with Local Transportation Cost Deductions

RogerRossmeisl

JANUARY 21, 2025

Understanding how to deduct transportation costs could significantly reduce the tax burden on your small business. You and your employees likely incur various local transportation expenses each year, and they have tax implications. Lets start by defining local transportation.

Let's personalize your content