2023 in review: The year in sales tax

TaxConnex

JANUARY 4, 2024

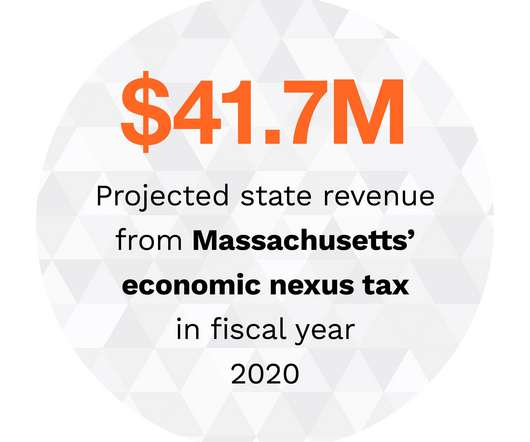

No year’s ever dull in sales tax, and the pace has only accelerated in the five years since the Supreme Court’s Wayfair decision. As we start the new year, here’s a look back at some significant sales tax events from 2023. This year, multiple states introduced new sales tax exemptions, too.

Let's personalize your content