IRS Suggests All Taxpayers Get IP PIN for More Security When Filing Taxes

CPA Practice

OCTOBER 23, 2024

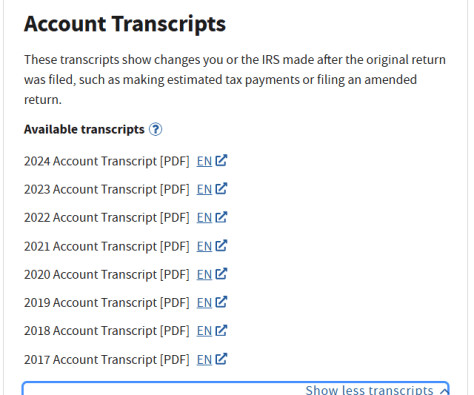

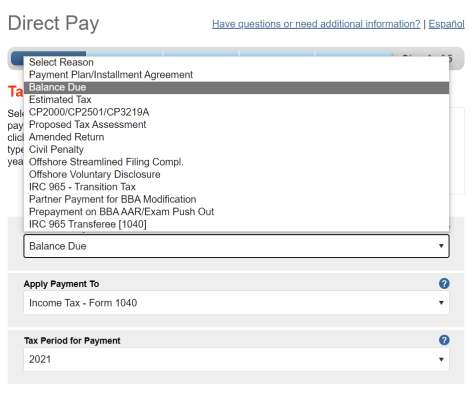

With the 2025 income tax filing season coming soon, the IRS is encouraging all taxpayers to take an important step to safeguard their identity by signing up for an identity protection personal identification number (IP PIN). How to request an IP PIN The best way to sign up for an IP PIN is through IRS Online Account.

Let's personalize your content