Partnership Income Tax Returns & More Skagit County IRS Targets

SkagitCountyTaxServices

NOVEMBER 8, 2023

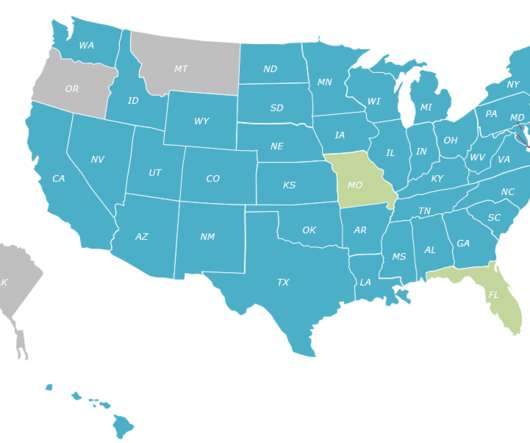

Even if your business isn’t centered on retail, are there offers you can create to capitalize on Black Friday? The IRS will be focused less on working-class taxpayers and increasingly toward high-income individuals and corporations. Because these groups have seen sharp drops in audit rates during the past decade.

Let's personalize your content