Missouri Enacts Economic Nexus

TaxConnex

JULY 6, 2021

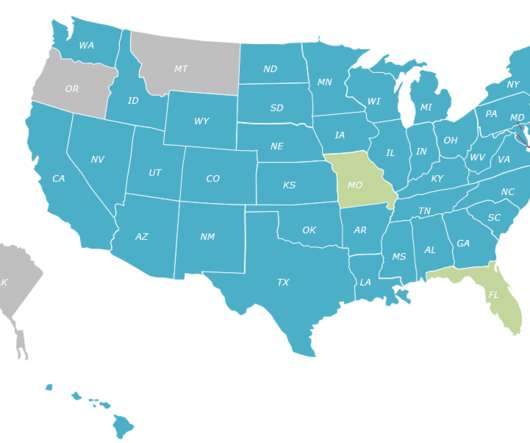

Missouri has officially become the last state with a state-wide sales tax to enact economic nexus. Missouri Gov. Mike Parson has signed SB153 (combined with SB97) into law, allowing Missouri and local jurisdictions to collect use tax and, proponents say, help protect local brick-and-mortar businesses.?. South Dakota v.

Let's personalize your content