Tax Fraud Blotter: What a relief

Accounting Today

APRIL 4, 2024

Chief culprit; tag, you're it; trust them not; and other highlights of recent tax cases.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

tag

tag  Tax Related Topics

Tax Related Topics

Accounting Today

APRIL 4, 2024

Chief culprit; tag, you're it; trust them not; and other highlights of recent tax cases.

TaxConnex

SEPTEMBER 15, 2022

If you are a business that must collect and remit sales tax, an audit is probably one of your biggest fears. Rightly so: Sales tax audits can find fault with a variety of your operations and can cost you big– if the determination goes against you. Determining where you have nexus is key to determining your sales tax liability.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TaxConnex

APRIL 11, 2023

If you are a business that must collect and remit sales tax, an audit is probably one of your biggest fears. In fact, our annual survey of financial professionals on sales tax trends has ranked sales tax audits as a top worry for the third year in a row. Not expecting an audit – Why would you get tagged for audit?

Shay CPA

FEBRUARY 14, 2024

Does thinking about filing your taxes put some tension on your shoulders? By giving you a heads-up in some key areas, we can make filing your tech company’s 2024 taxes a whole lot easier — and less stressful. He teed up a few tips to help you avoid unwelcome surprises as you navigate your 2024 tech company tax filings.

Menzies

JANUARY 20, 2023

We’re devised this ‘Finance Directors’ tax toolkit’ to highlight the ways in which Menzies often help large and multinational companies including business tax, employment solutions and innovation incentives (e.g. Transfer pricing Transfer pricing is not only a tax compliance requirement.

CPA Practice

SEPTEMBER 25, 2023

TAG Alliances Welcomes Ray Polantz of Cohen & Company as New Advisory Board Member TAG Alliances, a leading multidisciplinary alliance of independent professional services firms, recently appointed Raymond Polantz, Tax Partner at Cohen & Company as its newest Advisory Board member.

CPA Practice

MARCH 20, 2024

33-11070; 34-95025 ( annual reports for employee benefit plans for Form 11-K ), crypto assets , segment reporting , improvements to income tax disclosures , joint venture formations , and investments in tax credit structures. SEC details and guidance are available at the SEC’s Office of Structured Disclosure.

Airbase

NOVEMBER 15, 2023

Build vendor questionnaires into your workflows to capture information such as payment and tax details, and documents such as W-9s, right from your vendors. GL tag policy. Reduce sync errors by configuring your tag policy in Airbase to match the tag policy in your GL. Changes that make life easier for accountants.

Shay CPA

MARCH 29, 2023

Does thinking about filing your taxes put some tension on your shoulders? By giving you a heads-up in some key areas, we can make filing your tech company’s 2022 taxes gets a whole lot easier — and less stressful. He teed up a few tips to help you avoid unwelcome surprises as you navigate your 2022 tech company tax filings.

Accounting Insight

MAY 19, 2023

Accounting software specialist, Bright, has launched its new cloud tax and compliance product at Accountex 2023. Accountants will be able to access client information in-browser to work on and submit Individual Tax Returns, VAT returns and Corporation Tax returns to HMRC as well as annual accounts to Companies House.

Dent Moses

MARCH 17, 2022

If you itemize your deductions, you are allowed a deduction on your federal return for certain taxes you paid. The deduction is commonly referred to as SALT, which is short for state and local tax. This includes real estate taxes, personal property taxes (ie car or boat tags) and state and local income taxes.

CPA Practice

DECEMBER 19, 2023

33-11070; 34-95025 ( annual reports for employee benefit plans for Form 11-K ), crypto assets , segment reporting , improvements to income tax disclosures , joint venture formations , and investments in tax credit structures. SEC details and guidance are available at the SEC’s Office of Structured Disclosure.

Shay CPA

NOVEMBER 1, 2023

That’s particularly true when it comes to your taxes. Even if you’re operating at a loss and don’t have a tax liability yet, tax credits matter. Code allows you to carry those forward for up to 20 years , which means things you’re doing today can go a long way toward shrinking your tax bill in the future.

CPA Practice

APRIL 11, 2024

McGarry, InsideSources.com (TNS) Tax Day looms, and the taxman cometh. This year, the IRS has launched a pilot program dubbed “Direct File” through which Americans can opt to have the IRS prepare their taxes for free (well, except for the billions of taxpayer dollars used to create the program). By David B.

Accounting Insight

APRIL 30, 2024

Offering seamless switching between parent and group, advanced drill-down and editing on-the-fly, visibility and variability of group structure, iXBRL tagging and more. Wolters Kluwer Tax & Accounting UK (Stand 1460) has launched CCH iFirm®, its award-winning cloud-based practice management and compliance software platform.

xendoo

JANUARY 6, 2022

A crucial component of being a small business owner is meeting certain tax requirements in order to remain compliant in the eyes of the IRS. That is why the Xendoo team has created this guide to help business owners stay on top of their tax requirements, remain compliant throughout the year, and effortlessly maximize their return!

SkagitCountyTaxServices

APRIL 27, 2023

If you don’t have a big staff and get pulled in a lot of different directions and you’re doing the mundane task of organizing your tax documents … you might be a small business owner. That’s why, today, I’m laying out the tax document 411 for you, so you can be equipped to face that task and put it in the hands of a trusted team member.

CPA Practice

SEPTEMBER 25, 2023

I want to dive into the essential aspects of pricing advisory services to help my tax and accounting peers navigate this crucial aspect of their practice. Here’s what I mean: Does the client have certain unique aspects to their business, such as inventory, software as a service, project costing, and/or sales tax?

PYMNTS

DECEMBER 27, 2019

Sales taxes empower governments to maintain critical public services, but they can also make medical essentials too expensive for those who need them. Campaigns against taxing obligatory items are spreading across the United States, forcing states to rethink their revenue generation decisions. Sales taxes’ price tags.

PYMNTS

DECEMBER 26, 2019

Merchants aiming to sell nationwide must pay attention to how their goods are treated by each state’s tax code. Items considered as exempt medical necessities in some states may be taxed at high rates in others, and businesses cannot afford to be caught by surprise. Around The Next-Gen Sales Tax Wor ld.

LyfeAccounting

JULY 7, 2021

But something that a lot of people is just not thinking about are property taxes. Property taxes are based on the value of your home, so as home prices surge, so will your property taxes. How can you save on property taxes? Because today, we’re going to give you the steps on how to pay less in property taxes.

CPA Practice

JULY 13, 2023

For example, when high-profile tax fraud occurs, share tips about tax fraud prevention, internal controls, and penalties. Then, in her social media posts, she could tag the golf course and add golf-related hashtags to increase content viewership. Trends can also be influencers.

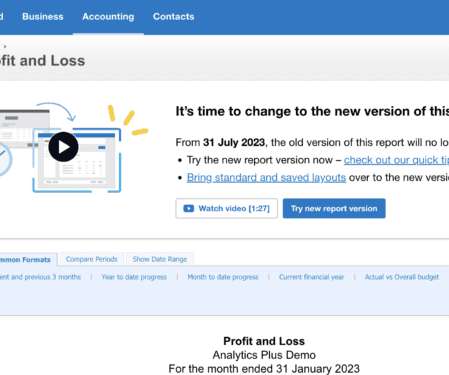

Xero

FEBRUARY 12, 2023

When you search for a report or view your favourites, you’ll see a tag letting you know it’s an old version. These tags will continue to be added to old reports as more new reports become available. In the months ahead, the ‘Old version’ tag will change to ‘Retiring 31 July 2023’, so you know they won’t be available after that date.

MyIRSRelief

SEPTEMBER 1, 2022

In particular, the expansion of the IRS and it tax enforcement arm will result in more taxpayers seeking IRS audit & appeals help as it comes into effect starting next year. In this case, it is the enforcement of current tax laws that is the focal point. However, the cost of greater enforcement does come with a price tag.

LyfeAccounting

JULY 2, 2021

Tax refund delays are completely out of control right now. Calling appears pointless as it is mostly automated, and checking your status on irs.gov only shows you if your tax return has been received by the IRS. But, it does not tell you why your tax refund is delayed. 9 Reasons Why Your Tax Refund is Delayed.

CPA Practice

OCTOBER 11, 2023

Illinois ranked 19 th in the study, where it’s estimated a family will spend $22,310 annually on raising their child when accounting for expenses like rent, food, child care, apparel, transportation, health insurance premiums, and state tax exemptions or credits.

Xero

APRIL 11, 2023

You’ll also be able to save photos to your phone, update profile details, change your password in the app, and more.

Xero

APRIL 13, 2023

Don’t forget to replace your favourites in the report centre with the new version of that report, as you’ll only be able to favourite new reports in the months ahead.

CPA Practice

JULY 10, 2023

For example, when high-profile tax fraud occurs, share tips about tax fraud prevention, internal controls, and penalties. Then, in her social media posts, she could tag the golf course and add golf-related hashtags to increase content viewership. Trends can also be influencers.

Xero

JANUARY 31, 2023

Real-time data in Xero Tax — New Zealand To make sure your pre-populated data is always up to date, we’re switching to real-time updates within Xero Tax. This will be automatically triggered when you create a new tax return in Xero. You can still manually code individual items if you prefer.

PYMNTS

MARCH 13, 2018

The law firm linked those costs to both tax and non-tax barriers to cross-border business. Those costs would be the result of the U.K.’s s adherence to World Trade Organization trade rules if it is unable to negotiate a more favorable trade deal with the EU before Brexit. companies would be hit with $37.5

Withum

DECEMBER 23, 2023

Small business owners have been suffering in recent years with various federal tax laws impeding their ability to operate and grow. Congressional leaders went home this week for winter recess so there is no way for a tax extender bill to be passed in 2023, but there remains a glimmer of hope for action in early 2024. Ensuring the U.S.

Ronika Khanna CPA,CA

JULY 28, 2023

One of the most important reasons business retain documents is to satisfy the tax authorities , which require backup documentation for all transactions that are ultimately reported on a tax return. As a business owner, making sure that you are onside with government requirement is essential.

PYMNTS

MARCH 20, 2020

The International Council of Shopping Centers (ICSC) says it believes action from the federal government is needed, and large retail brands began to put a price tag on the revenue losses they expect to face. 400B: Approximate amount in state and local taxes the shopping industry generates in the U.S. All this, Today in Data.

Accounting Today

AUGUST 16, 2023

The cost of the IRA's uncapped tax credits and incentives is almost impossible to pin down.

Shay CPA

SEPTEMBER 13, 2023

They’re in the weeds with your accounting systems, overseeing everything from balancing your books to maintaining tax compliance. They should also have expertise in the tax requirements that apply to your specific company based on both its type and location. A controller’s role is focused on execution and accuracy.

Withum

OCTOBER 4, 2022

Unfortunately, the ability to sell EVs comes with quite a price tag and a very short timeframe (October 31, 2022) for dealers to commit. This option comes with a $500,000 price tag. As a result, the news from Ford feels more like an ultimatum as opposed to a business opportunity. million in sales.

Snyder

AUGUST 8, 2022

Depending on the policies of some payment platforms, you can record details such as sales amounts, taxes, processing fees, items, customers, classes, shipping and discounts to the connected accounting software automatically. Why Synder? You don’t have to worry about the state of the business’s books when you’re using the right tool.

SkagitCountyTaxServices

JULY 29, 2022

You’re doing your best to keep employees happy, raise prices without driving away customers, pivot to alternative supply options as your current ones dry up, adjust for changing tax laws, etc, etc, etc. So if you need some time to just talk over a specific financial decision, or navigate your future tax liability (i.e. owner=19530343.

Ronika Khanna CPA,CA

JUNE 10, 2022

In this case you do not have to pay GST/HST or QST on these services as long as you are registered for sales tax and provide your registration numbers to the foreign seller (they will send an email asking you for this information).

SkagitCountyTaxServices

JULY 12, 2023

Freelancers and independent contractors tend to be more expensive upfront, but they do spare you the price tags of health insurance and other perks and payroll taxes. Be aware that tax authorities are watching more closely now whenever companies claim a worker is an “independent contractor” without adhering to many conditions.

Going Concern

JUNE 9, 2022

This is the weirdest game of tag ever. Per earlier WSJ coverage KPMG and PwC do not plan to be “it” any time soon: KPMG and PricewaterhouseCoopers, the other members of the Big Four, say they will stick to their existing approach of offering consulting and tax services alongside the bread-and-butter audit work.

SkagitCountyTaxServices

APRIL 13, 2022

Tax deductibility. Enter small business accounting software, which can also organize receipts, reconcile your books and talk to us and your bank to take a lot of tax and money-related stuff off your plate – not to mention lower the chances of an expensive mistake. The price tag. The plus side of looking into these?

PYMNTS

AUGUST 24, 2020

The news comes as a new Indian equalization measure came into existence in 2020 that puts a 2 percent tax on every digital transaction that foreign online shopping firms conduct. Facebook first let American and Canadian users move their videos and pictures to Google Photos in April.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content